Get the free form non15g

Show details

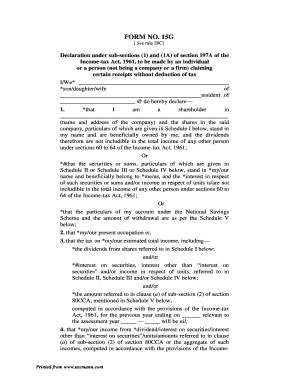

FORM NO. 15H See rule 29C(1A) Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more claiming certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form non15g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form non15g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form non15g online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample filled form 15g see rule 29c. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out form non15g

How to fill out form non15g:

01

Obtain a copy of form non15g from the relevant authority or download it from their official website.

02

Read the instructions carefully to understand the requirements and eligibility criteria.

03

Fill in your personal details accurately, including your name, address, PAN (Permanent Account Number), and contact information.

04

Provide details of the previous year in which the form is being submitted, such as the assessment year, previous year's income, and taxable income.

05

Mention your previous year's tax liability and any taxes already deducted.

06

Declare that you meet the necessary conditions to submit form non15g and that the income mentioned is not liable for TDS (Tax Deducted at Source).

07

Attach supporting documents, such as income statements, bank statements, or any other relevant documents required by the authority.

08

Sign and date the form before submission.

Who needs form non15g:

01

Individuals who are Indian residents and want to declare that their total income is below the taxable limit, which exempts them from TDS.

02

Individuals who have income from interest on certain securities, fixed deposits, or other investments and want to avoid tax deduction at source.

03

People who meet the conditions laid down by the authority regarding the eligibility to submit form non15g in order to prevent tax deduction on their income.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form non15g?

Form Non15G is a document that needs to be submitted by an individual to the financial institution in order to claim exemption from tax deduction at source (TDS) on specific incomes. This form is applicable to residents of India. By submitting this form, individuals declare that their total income falls below the taxable limit and they are eligible for exemption from TDS.

Who is required to file form non15g?

Form non15g is not a known or recognized form. There might be a misunderstanding or confusion regarding the form name. The Internal Revenue Service (IRS) has various forms for different purposes, such as Form 1099 for reporting income, Form W-2 for wage and tax statement, and Form 1040 for individual tax return. Without a specific form number or more information, it is not possible to determine who may be required to file a form non15g.

How to fill out form non15g?

To fill out Form 15G, follow these steps:

1. Obtain a copy of Form 15G: You can download the form from the Income Tax Department's official website or collect it from your bank or financial institution.

2. Read the instructions: Go through the instructions provided with the form carefully. This will help you understand the requirements and fill out the form correctly.

3. Personal details: Provide your personal details at the top of the form such as name, address, PAN (Permanent Account Number), mobile number, and email address.

4. Financial information: Fill in details of your financial transactions for which you are submitting the form. This includes details like the name of the payer, income type, estimated total income for the financial year, estimated total income for the previous year, etc.

5. Declaration: Read and understand the declaration provided at the bottom of the form. Tick the appropriate boxes to confirm that you fulfill the required conditions mentioned. Sign and date the form.

6. Attach supporting documents: If required by the payer, attach necessary supporting documents such as a photocopy of your PAN card.

7. Submission: Submit the filled-out Form 15G to the relevant institution, such as your bank or financial institution, as per their guidelines. Retain a copy of the form for your records.

Note: While filing Form 15G, ensure that you qualify as per the specified criteria, which generally includes being an individual or HUF (Hindu Undivided Family) with no tax liability for the financial year. It is advisable to consult a tax professional, if needed, to ensure proper compliance with tax laws.

What is the purpose of form non15g?

Form Non-15G is used by individuals or Hindu Undivided Families (HUFs) to declare that their income is below the taxable limit and they are not liable to pay any tax on the interest earned on fixed deposits, recurring deposits, or other specified investments. The purpose of this form is to provide a declaration to the bank or financial institution that they should not deduct tax at source (TDS) on the interest income. By submitting Form Non-15G, eligible individuals can avoid any unnecessary deductions and receive the full interest amount.

What information must be reported on form non15g?

Form Non15G is applicable for the declaration of income earned by Non-resident Indians (NRIs) from specific sources in India, such as dividends, interest, or royalties. The information that must be reported on Form Non15G includes:

1. Personal Details: The form requires the individual to provide their full name, residential address, email address, and contact number.

2. PAN (Permanent Account Number): The PAN of the NRI must be mentioned in the form.

3. Type of Income: The specific type of income for which the declaration is being made needs to be stated, such as interest, dividends, or royalties.

4. Nature of Remittance: The form requires the NRI to mention the nature of remittance, i.e., whether it is in the form of repatriation or non-repatriation.

5. Amount of Income: The NRI needs to mention the total amount of income earned during the financial year for which the declaration is being made.

6. Tax Residency Status: The NRI should provide information about their tax residency status in the applicable country (where they are a tax resident), along with supporting documents if required.

7. Declaration: The form includes a declaration by the NRI stating that the information provided is true and correct.

It is important to note that the specific requirements and format of the form may differ based on the guidelines issued by the relevant tax authority. Therefore, it is advisable to refer to the official instructions or consult a tax professional while filling out Form Non15G.

What is the penalty for the late filing of form non15g?

The penalty for the late filing of Form 15G is determined by the income tax department of the respective country. It is advisable to refer to the official tax guidelines or consult with a tax professional to get accurate information regarding the penalty for late filing in your specific jurisdiction.

How can I modify form non15g without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including sample filled form 15g see rule 29c, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get 15g form fill up procedure see rule 29c?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the how to fill form no 15g section 197a 1a and rule29c in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in sample of 15g see rule 29c form filled?

With pdfFiller, the editing process is straightforward. Open your form non15g in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Fill out your form non15g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

15g Form Fill Up Procedure See Rule 29c is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.